Why strong financial foundations are key to business growth

In today’s competitive business world, success isn’t just about having a great product or service—it’s about managing your finances effectively. Finance and accounting play a crucial role in ensuring that your business operates smoothly, grows sustainably, and remains profitable in the long run.

Here’s why finance and accounting are at the heart of every successful business and how the right tools can make all the difference.

1. Setting a Strong Foundation for Decision Making

Without accurate financial data, making informed business decisions is nearly impossible. Finance and accounting provide the data that shapes your strategic plans. This includes everything from sales forecasts to expense tracking and profit margins. A robust financial system ensures you have the right numbers at your fingertips to make informed decisions that move your business forward.

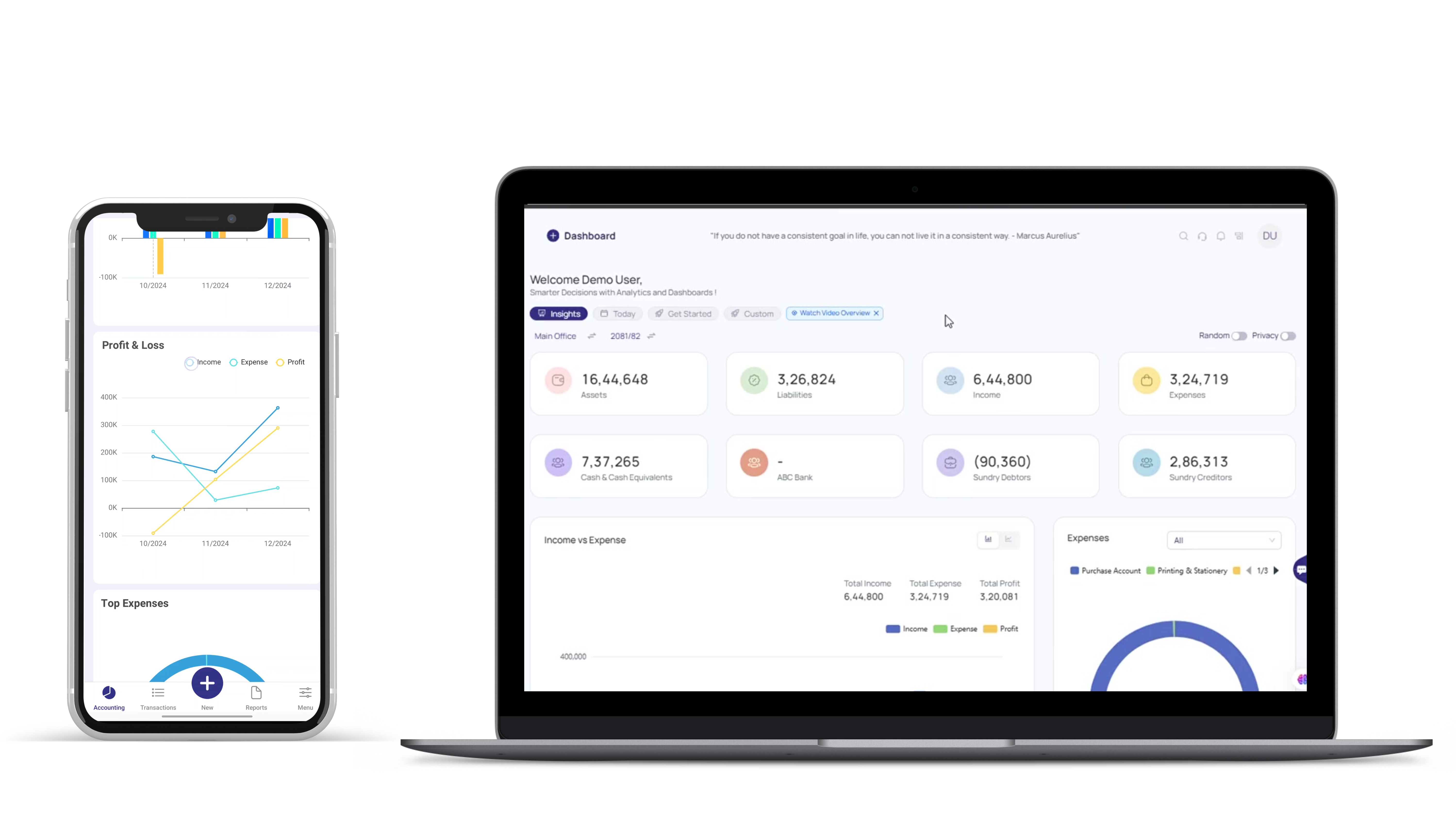

With OneFlow, you can access up-to-date financial insights at any time—allowing you to make real-time decisions with confidence.

2. Maintaining Cash Flow and Financial Health

One of the most common reasons businesses fail is poor cash flow management. Your cash flow—how money flows in and out of your business—determines your ability to pay employees, suppliers, and reinvest in growth. Effective accounting practices help track cash flow and ensure that you can manage income and expenses efficiently.

By using OneFlow‘s accounting software, you can monitor your cash flow in real-time, ensuring you’re never caught off guard by unexpected shortfalls.

3. Budgeting for Growth

Every business needs a clear, actionable budget. Budgeting ensures that your resources are being allocated effectively, preventing overspending and helping you plan for future growth. Without proper budgeting, even a profitable business can quickly run into financial trouble.

With OneFlow, creating and tracking budgets becomes easy. The platform’s budgeting tools allow you to set realistic targets and adjust as needed, keeping your business on track.

4. Ensuring Compliance and Minimizing Risk

Keeping up with ever-changing financial regulations, tax laws, and compliance requirements can be a major headache for business owners. But the cost of failing to comply is high—ranging from fines to potential legal consequences. Strong financial management ensures that your business remains compliant and reduces the risk of costly mistakes.

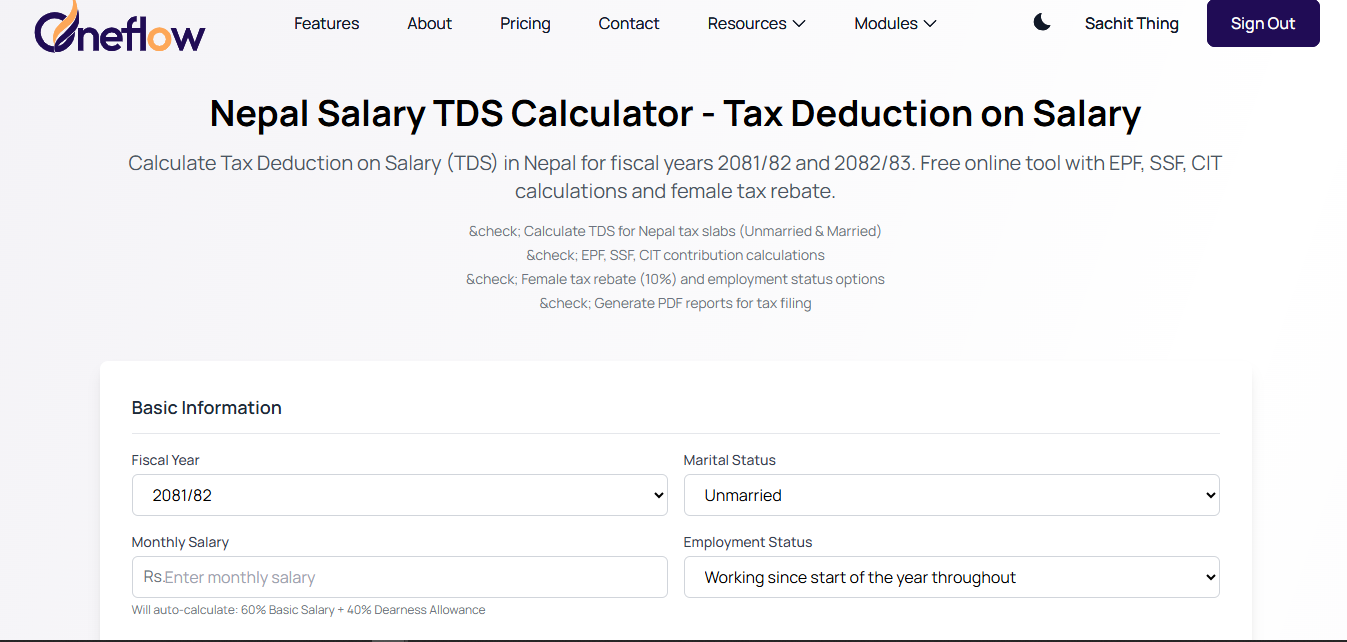

OneFlow helps businesses stay compliant by automating tax calculations, generating necessary reports, and maintaining audit trails, so you can focus on growth without worrying about legal headaches.

5. Attracting Investors and Securing Financing

For businesses that seek to grow, attracting investors or securing loans is often a key milestone. Financial health plays a major role in this process. Investors and lenders look for businesses with strong financial practices and transparent records, ensuring that their investments are in good hands.

OneFlow enables you to generate professional financial statements and reports that provide potential investors and lenders with a clear, reliable picture of your business’s financial status.

6. Measuring Profitability and Business Performance

Financial data isn’t just for accounting—it’s essential for measuring business performance. By assessing profitability, margins, and cost structures, businesses can identify areas of strength and potential for improvement. The right financial insights allow you to fine-tune operations, reduce unnecessary expenses, and boost profitability.

With OneFlow, you get detailed financial reports that help you track key performance indicators (KPIs), giving you a clear view of how your business is performing and where you can improve.

Final Thoughts: Building a Strong Business with Solid Financial Practices

Finance and accounting are much more than just keeping track of numbers—they’re at the core of your business’s success. Strong financial practices enable smarter decision-making, healthy cash flow, growth planning, and risk management. Investing in reliable accounting software like OneFlow can help you maintain financial clarity, stay compliant, and drive business growth.

Ready to take control of your finances and achieve business success?

Visit oneflowerp.com

How to Use Financial Reports to Improve Your Business

5 Common Accounting Mistakes and How to Avoid Them

The Ultimate Guide to Budgeting for Business Growth