Paying suppliers on time can be a challenge for many Nepali businesses. From chasing approvals to keeping track of paperwork, the process often takes longer than it should. That’s why OneFlow has launched its New Payment-Request feature—a smarter way to request, approve, and manage supplier payments digitally.

What is a Payment-Request?

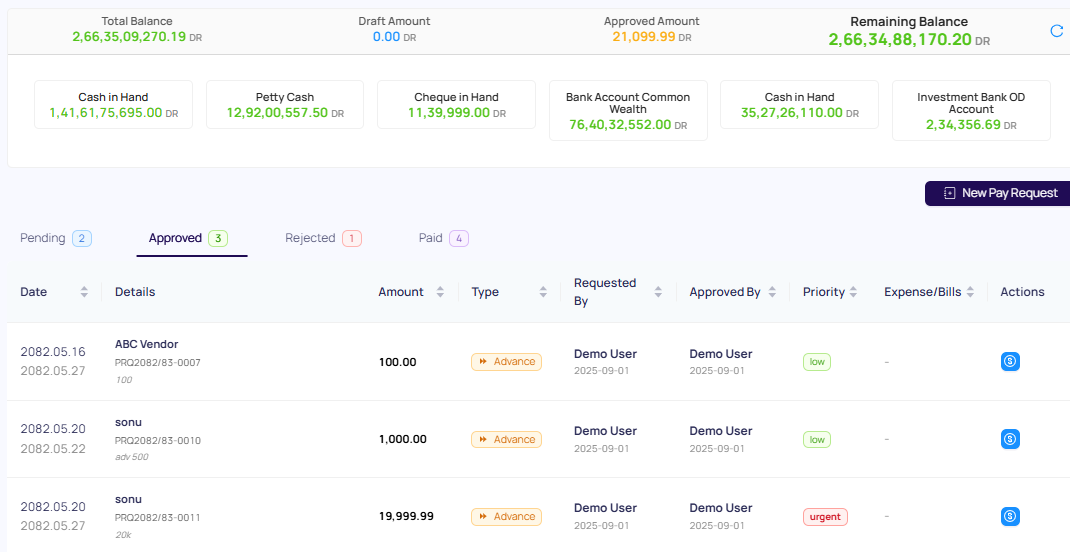

A Payment-Request is a digital tool inside OneFlow’s accounting software that makes supplier payments faster and more transparent. Instead of relying on manual approvals or endless follow-ups, businesses can now:

- Send structured requests for supplier payments.

- Get instant approvals from the right people.

- Track the status of every payment request in real time.

This ensures smoother workflows, fewer delays, and happier suppliers.

Why This Matters for Businesses in Nepal

Many Nepali companies face the same issues: delayed approvals, unclear payment status, and extra time wasted on manual coordination. The Payment-Request feature solves these problems by offering:

- Simplified workflows – No more paper trails or endless email chains.

- Automated reminders – Approvers get notified instantly.

- Clear reconciliation – Every request connects directly to accounting records.

- Time savings – Finance teams and business owners can focus on growth instead of paperwork.

Benefits for Small and Growing Companies

Whether you’re running a startup, a small business, or a growing enterprise, the Payment-Request feature makes life easier:

- Faster approvals → Suppliers get paid on time.

- Professional processes → Branded requests make your business look organized and credible.

- Transparency → Both you and your suppliers can track where a payment stands.

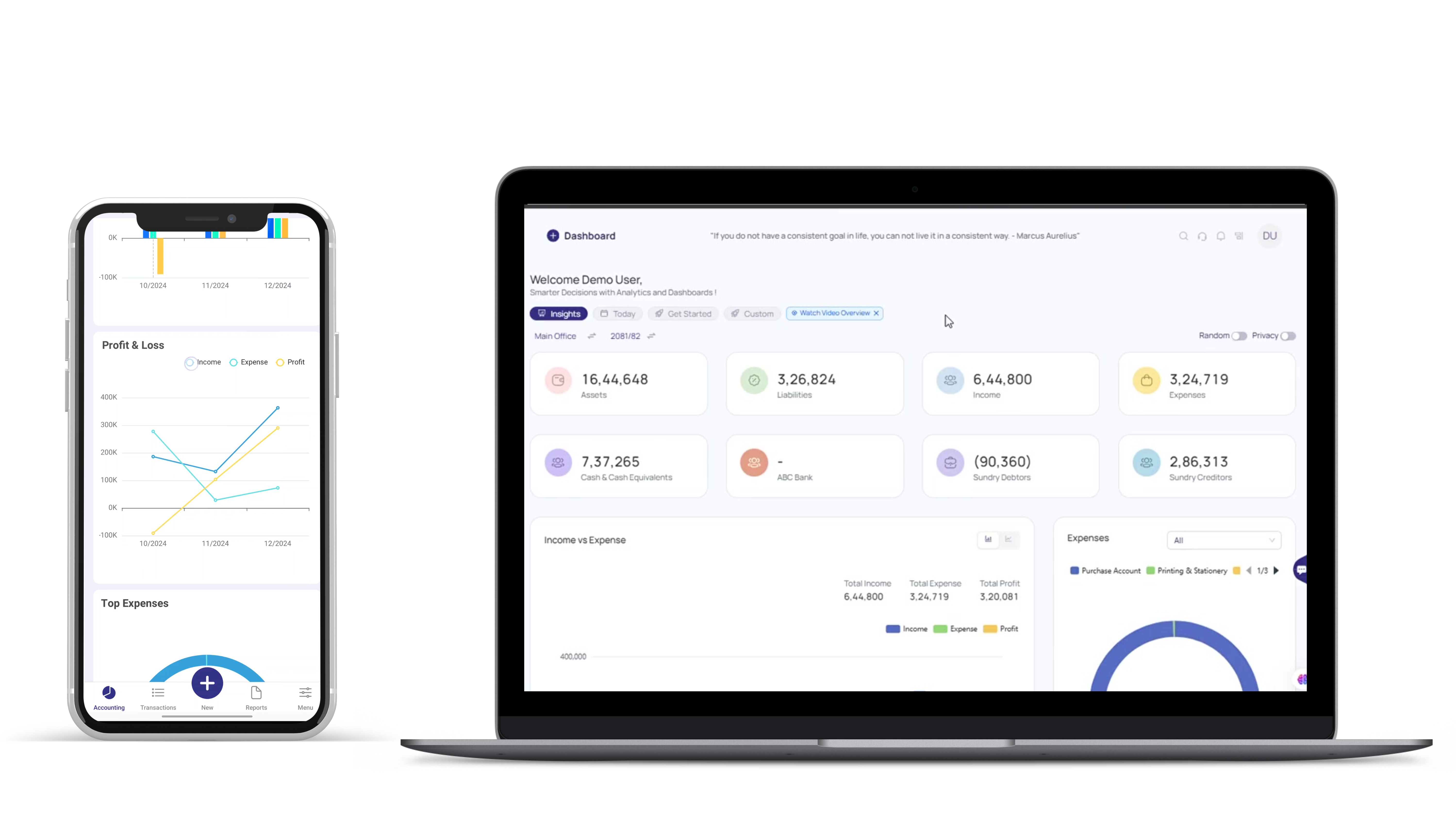

- OneFlow integration → Everything connects seamlessly with invoices and reports.

The Future of Supplier Payments in Nepal

As Nepal continues moving toward digital-first solutions, businesses that adopt modern tools will stay ahead of the curve. OneFlow’s Payment-Request feature is designed to reduce manual work, improve supplier relationships, and keep financial operations running smoothly.

👉 If you want your business to stay ahead, start using OneFlow’s Payment-Request today and experience smarter, faster, and stress-free payments.