Revolutionize Your Finances for Free with OneFlow – Nepal’s Premier Free Accounting Software

In the fast-paced world of Nepalese business, finding a reliable yet free accounting software is no longer a challenge, thanks to OneFlow. Unveiling a game-changing offer, OneFlow now provides a free account tailored for businesses in Nepal, empowering you to take control of your finances without breaking the bank.

Discover Financial Freedom with OneFlow’s Free Accounting Software:

Gone are the days of compromising functionality for cost. OneFlow’s free accounting software is a testament to the commitment of providing accessible financial management tools for businesses of all sizes in Nepal. Let’s delve into why OneFlow’s free version is your gateway to seamless and cost-effective accounting.

1. A Taste of Excellence for Free: Experience the power of OneFlow without spending a dime. Sign up for a free account and revel in the efficiency of a world-class accounting software without upfront costs. This is not just a trial; it’s a glimpse into financial management excellence.

2. Generous Limits for Small Businesses: OneFlow’s free version is designed with small businesses in mind. Enjoy up to 50 transactions, manage 10 contacts, and keep track of 10 products without any cost. It’s the perfect solution for startups and SMEs looking to optimize their finances without committing to hefty subscription fees.

3. Seamless Upgrade Options: As your business grows, so do your accounting needs. OneFlow understands this journey, providing an easy and free upgrade path. When you’re ready to surpass the limitations, seamlessly transition to the upgraded version for expanded transaction volumes, more contacts, and increased product listings.

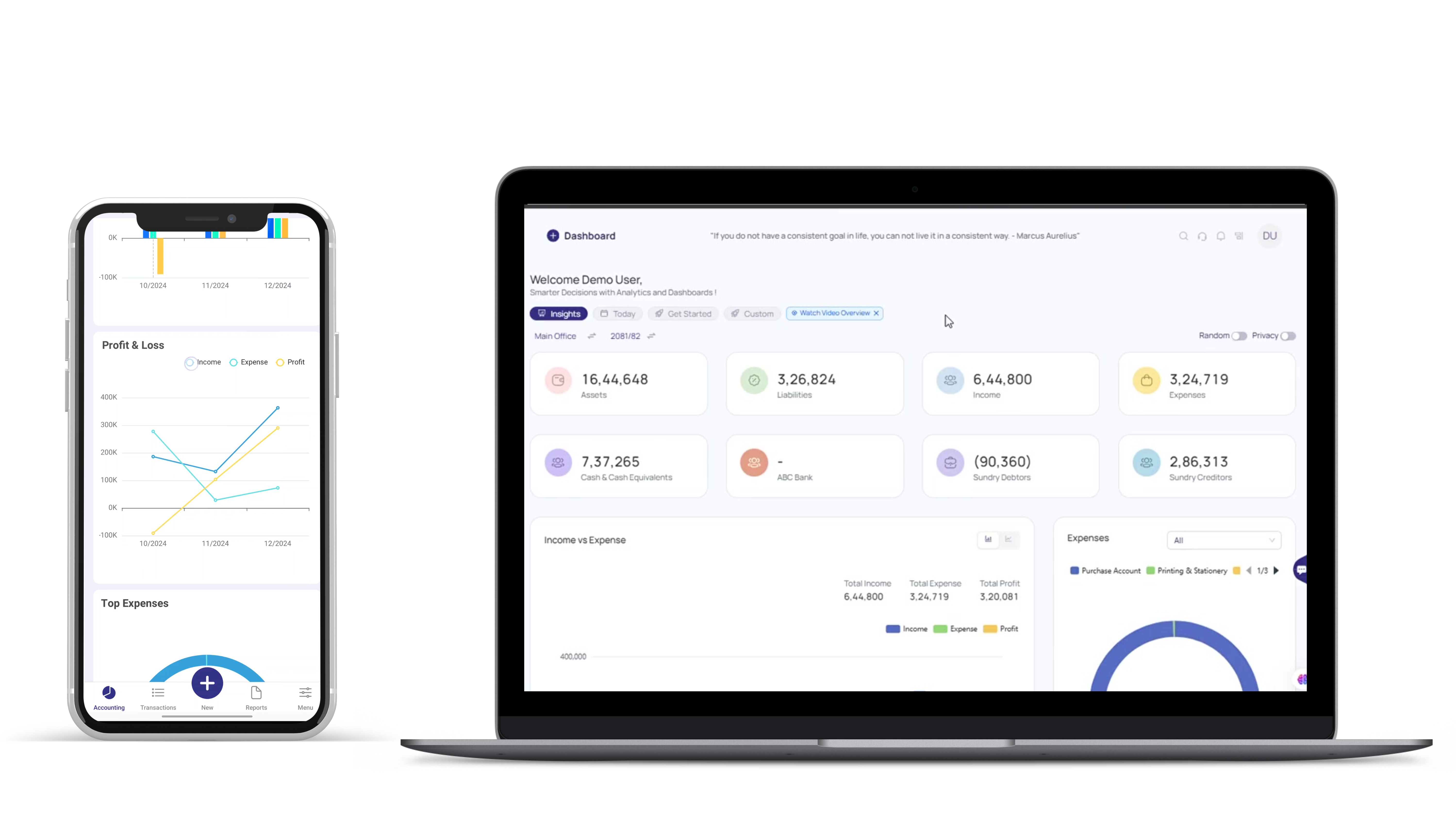

4. User-Friendly Interface, Zero Cost: OneFlow’s user-friendly interface, designed for simplicity, comes at no cost in the free version. Navigating the software is a breeze, ensuring that users, regardless of their accounting expertise, can effortlessly manage their finances. Say goodbye to complex systems with a price tag.

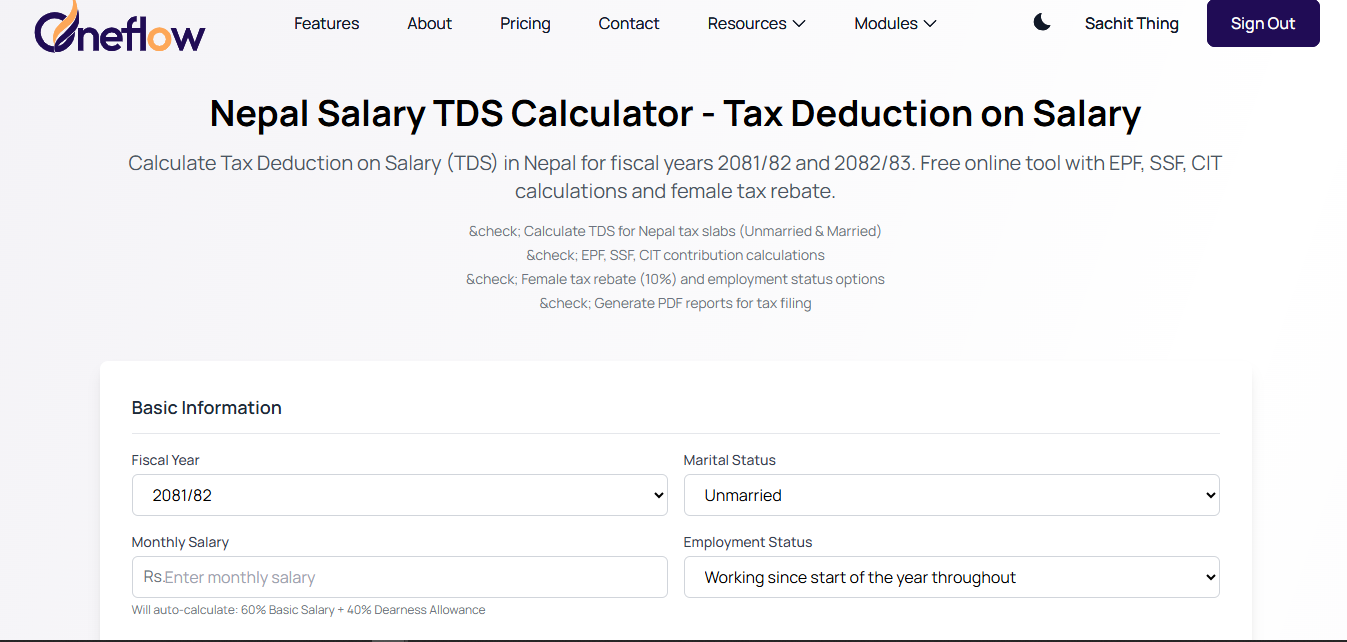

5. Localized for Nepalese Businesses: OneFlow’s free accounting software isn’t just generic; it’s specifically tailored for the unique needs of businesses in Nepal. With features compliant with local tax regulations, including VAT and TDS, and seamless integration with the Nepali date system, OneFlow ensures your financial records are accurate and legally sound.

6. Cloud-Based Accessibility, Always Free: Enjoy the freedom of accessing your financial data from anywhere, at any time. OneFlow’s free version operates on a cloud-based platform, eliminating the need for physical presence. Collaborate with your team, share data securely, and grant access to accountants hassle-free.

7. Real-Time Financial Insights, Without the Price Tag: Even in the free version, OneFlow provides real-time insights into your financial data. Monitor your business’s financial health daily, make informed decisions with generated reports, and stay ahead of the curve, all without spending a penny.

8. Upgrade to Premium – When You’re Ready: OneFlow’s free accounting software is just the beginning. When you’re ready to unlock premium features, seamless integration, and expanded capabilities, upgrading is a breeze. Enjoy the flexibility of upgrading without the pressure of immediate costs.

Embark on Your Financial Journey Today – Sign Up for Free:

Don’t miss out on the chance to transform your financial management without a hefty price tag. OneFlow’s free accounting software is more than an offer; it’s an opportunity to elevate your business without the financial strain.

Ready to revolutionize your finances for free? Sign up now and take the first step towards financial freedom with OneFlow. Click here to create your free account, and let the journey to seamless financial management begin. Your business deserves the best, and with OneFlow, the best comes free.