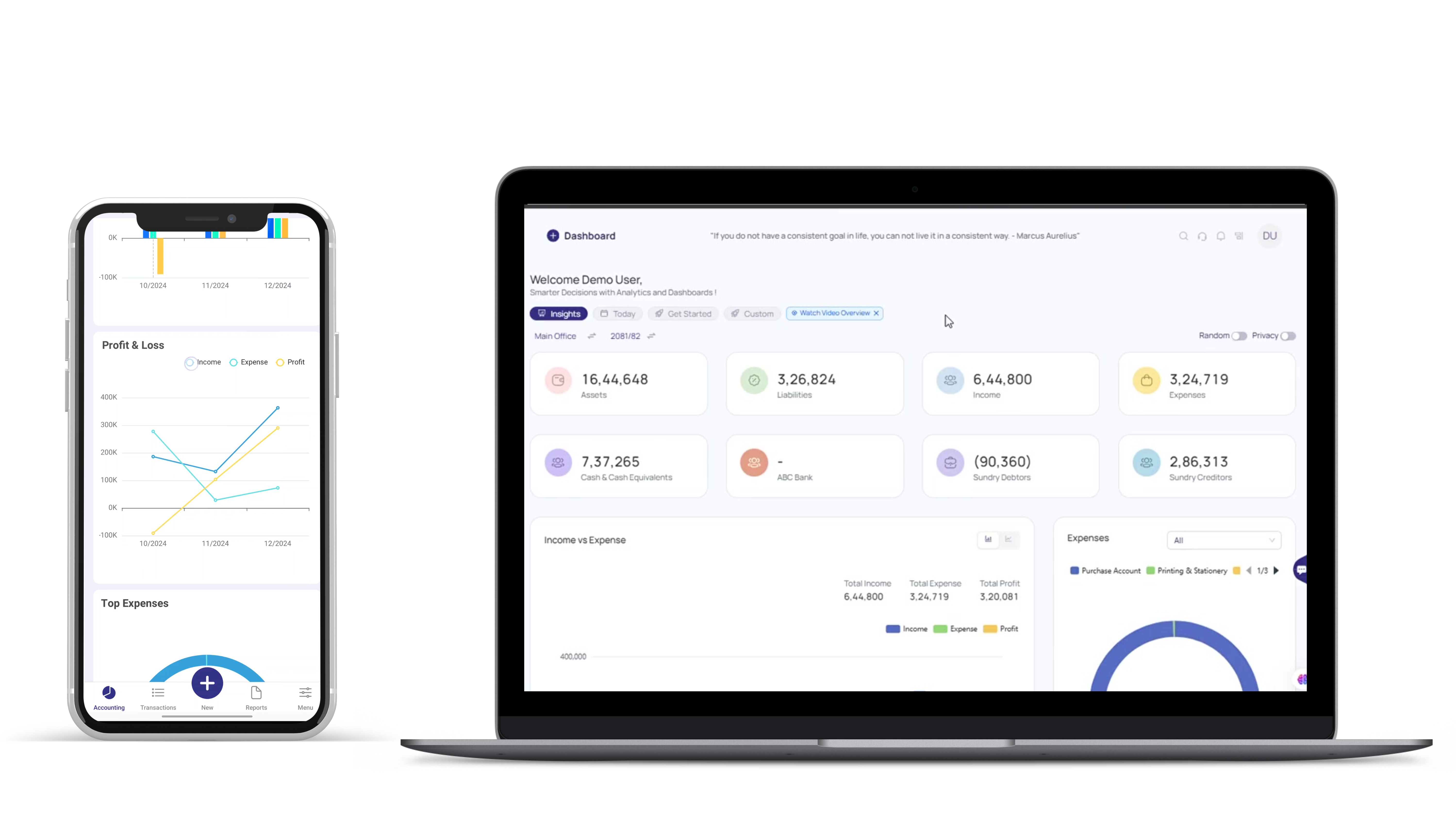

Managing your business finances doesn’t have to be complicated. With OneFlow Accounting Software, you get a robust and automated General Ledger system that keeps your financial data accurate, up-to-date, and audit-ready. From tracking income and expenses to generating financial statements, OneFlow simplifies it all—saving you time and boosting your financial confidence.

What Is a General Ledger?

A General Ledger (GL) is the backbone of your accounting system. It records every financial transaction and categorizes it into key accounts such as:

- Assets

- Liabilities

- Equity

- Income

- Expenses

This comprehensive structure helps you monitor your company’s financial health and prepare essential reports like balance sheets and income statements.

✅ How OneFlow Automatically Generates a General Ledger

OneFlow Accounting Software transforms manual accounting into an automated, seamless experience. Here’s how:

1. Automatic Transaction Entries

Each time you create a sale, purchase, or payment in OneFlow, it’s automatically recorded in your General Ledger under the appropriate account type. This reduces manual input and human error.

2. Real-Time Ledger Updates

Your GL updates in real-time with every transaction, giving you instant visibility into your financial data. Stay informed without waiting for monthly reports.

3. Customizable Account Categories

Whether you’re tracking sales income, operational expenses, or tax liabilities, OneFlow lets you tailor the chart of accounts to suit your specific business structure.

4. Built-In Reporting Tools

Generate comprehensive financial reports like trial balances, profit & loss statements, and audit logs directly from the General Ledger—perfect for tax filing and decision-making.

5. Always Audit-Ready

With an automatic audit trail, your financial data is transparent, traceable, and always ready for inspection—ensuring stress-free audits.

✅ Seamless Integration Across Modules

OneFlow’s General Ledger doesn’t operate in isolation. It integrates effortlessly with:

- Accounts Payable & Receivable

- Inventory Management

- Payroll

- Tax Reporting (VAT, TDS, Custom Taxes)

This creates a unified view of your finances, with all transactions flowing automatically into the GL.

✅ Why Businesses in Nepal Choose OneFlow’s General Ledger

Here’s why OneFlow is considered one of the best accounting software solutions in Nepal:

- ✅ Accuracy: Automated entries eliminate human error.

- ✅ Efficiency: Save hours with real-time data syncing.

- ✅ Compliance: Stay aligned with Nepalese tax laws and standards.

- ✅ Customization: Adapt the system to your unique business model.

- ✅ Audit-Ready: Easily generate and share audit trails.

Final Thoughts

With OneFlow’s General Ledger feature, you get more than just a financial record—you gain a real-time financial management tool. Whether you’re a growing startup or a large enterprise, OneFlow helps you stay organized, compliant, and confident in every financial decision