Managing your salary and understanding tax obligations can be a daunting task, especially with frequent changes in Nepal’s tax laws. For employees and employers alike, staying compliant with the Income Tax regulations is essential. This is where a Nepal Salary TDS Calculator becomes a powerful tool for accurate salary management.

What is TDS (Tax Deducted at Source) on Salary?

TDS on salary is the amount of tax that employers are required to deduct from an employee’s salary before making the payment. This ensures that employees pay taxes regularly, and it simplifies annual tax filing. In Nepal, TDS is calculated according to the Income Tax Act, 2058, and is based on the employee’s total income, deductions, and tax slab.

Why Use a Nepal Salary TDS Calculator?

Manually calculating tax deductions can be complicated and prone to errors. Here’s why a salary TDS calculator is essential:

- Accuracy: Automatically calculates TDS according to the latest tax slabs.

- Time-saving: Eliminates the need for manual computation and spreadsheets.

- Compliance: Ensures that both employers and employees follow the legal guidelines.

- Financial Planning: Helps employees understand their net salary after tax deductions.

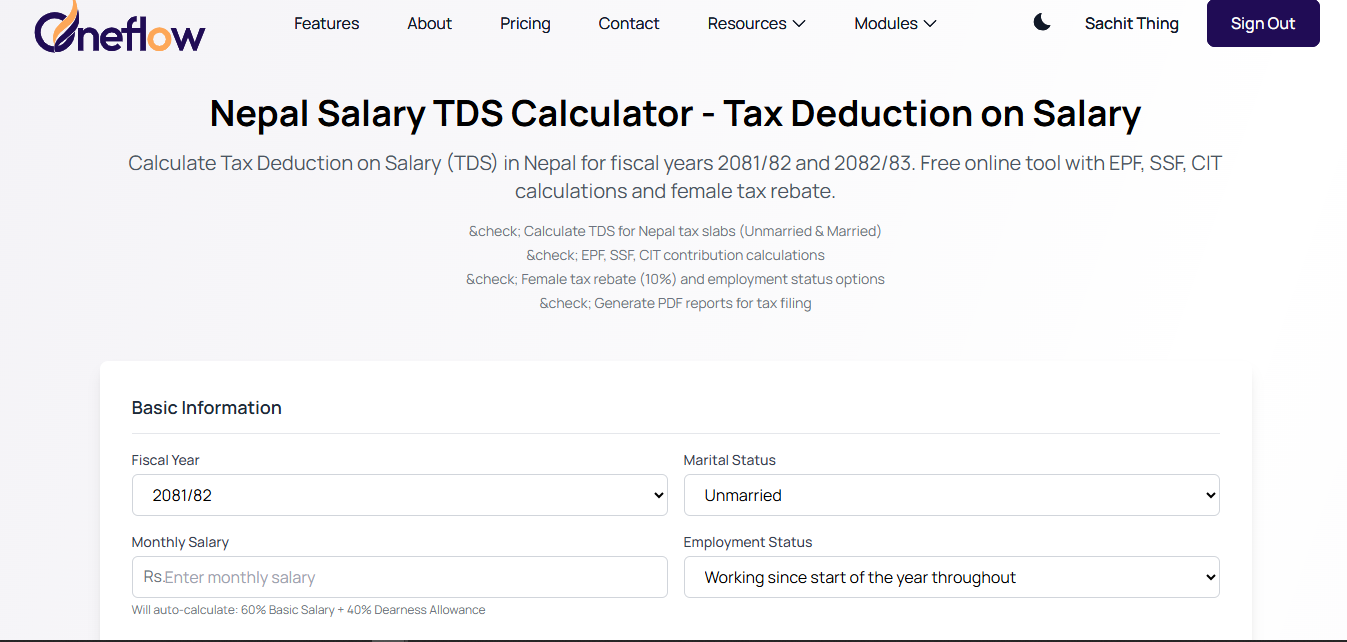

Features of OneFlow’s Nepal Salary TDS Calculator

At OneFlow, we provide a user-friendly TDS calculator tailored for Nepal’s tax system. Key features include:

- Automatic Tax Computation: Calculates monthly or yearly TDS based on current tax slabs.

- Customizable Salary Components: Include basic salary, allowances, bonuses, and deductions.

- Tax Exemptions & Reliefs: Accounts for exemptions under applicable laws, like provident fund contributions and insurance.

- Instant Net Salary Calculation: See the final salary you receive after tax deductions in seconds.

How to Use the Salary TDS Calculator

- Enter your basic salary and other allowances.

- Add any deductions or exemptions applicable.

- Click on “Calculate TDS”.

- View your tax amount and net salary instantly.

Using this tool, both employees and employers can simplify salary management and ensure accurate tax deduction every month.

Benefits of Using OneFlow for Salary Management

OneFlow is not just a TDS calculator. It’s a complete accounting solution for businesses in Nepal. Benefits include:

- Easy payroll processing

- Automatic tax compliance

- Efficient record keeping

- Detailed salary reports

With OneFlow, employers can focus on business growth while employees can plan their finances with confidence.

Conclusion

Understanding tax deductions on salary has never been easier. The Nepal Salary TDS Calculator from OneFlow ensures accurate, compliant, and hassle-free salary calculations. Simplify your payroll process today and take control of your finances with OneFlow Pro.

Try the Nepal Salary TDS Calculator now at OneFlow.pro – your partner in smart accounting.

Get there now…