Oneflow’s Reporting Tags let you categorize transactions beyond the chart of accounts—by project, client, branch, or campaign—for flexible, multi-dimensional financial reports. This keeps your chart clean and enables detailed insights like project profitability, branch performance, or campaign ROI. Simply create tags, assign them to transactions, and generate custom reports filtered or grouped by tags. With automation and consistent naming, Reporting Tags empower smarter decisions and clearer business intelligence for founders, accountants, and finance managers.

Read more...

Post

- OneFlow Launches Payment-Request in Nepal - 2 September 2025

- Accounting Software for Small Businesses Nepal - 27 August 2025

- Free Invoice Generator – Simplify Your Billing with OneFlow - 17 August 2025

- Nepal Salary TDS Calculator – Tax Deduction on Salary - 17 August 2025

- Create Smarter, Dynamic Reports with Reporting Tag – Oneflow Accounting Software - 17 August 2025

- OneFlow – Nepal’s IRD Approved E‑Billing & Accounting Software for 2025 - 17 August 2025

- Business Registration in Nepal – Complete Guide to Sole Proprietorship, Partnership, and Company Formation - 11 August 2025

- OneFlow – Nepal’s IRD Approved E‑Billing & Accounting Software for 2025 - 6 August 2025

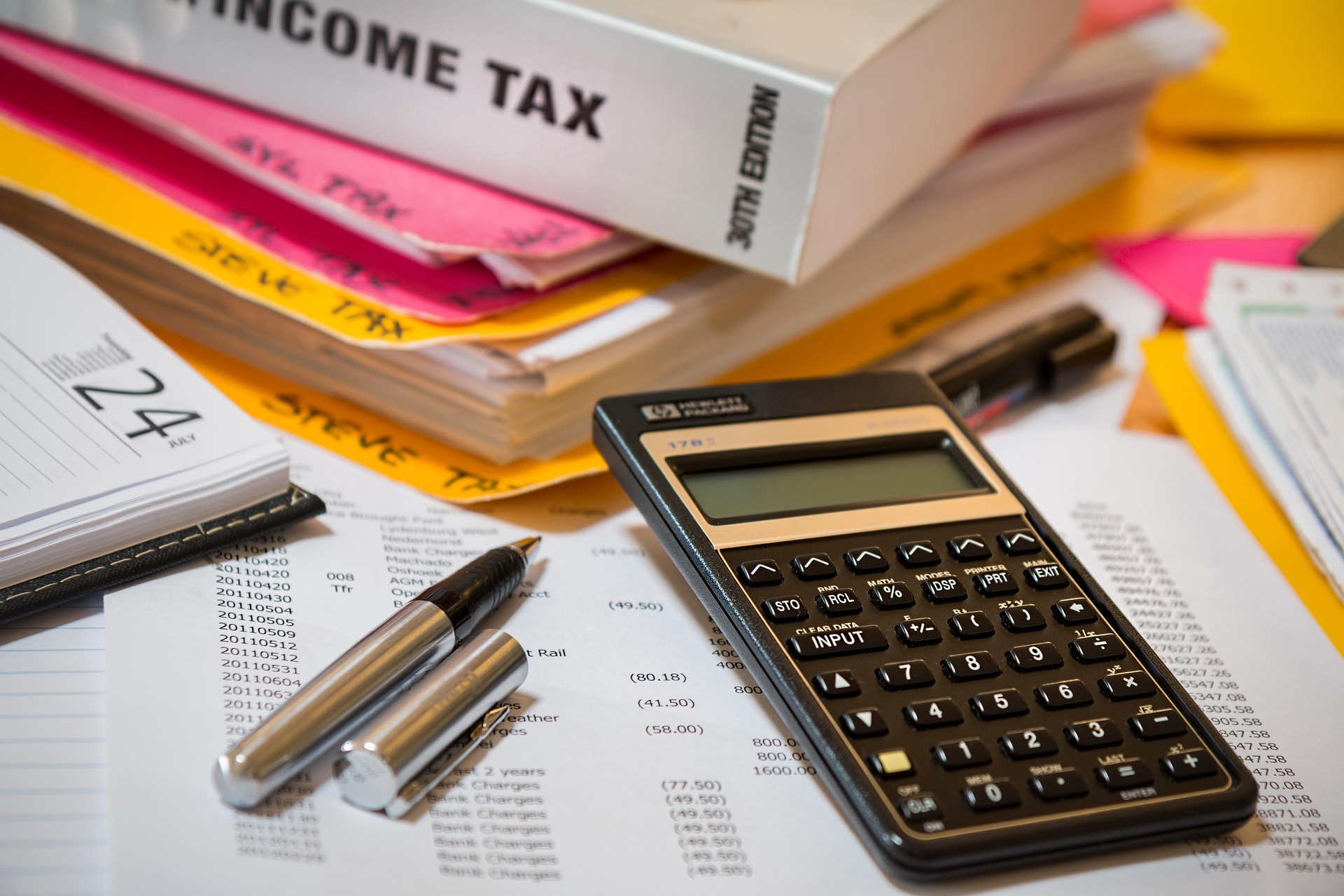

- Tax and VAT Highlights from Nepal Budget 2082 – Key Highlights & Insights - 6 August 2025

- Topline vs Bottomline: What Shark Tank Investors Are Really Asking - 17 August 2025

- Mental Health Tips for Small Business Owners: How to Stay Balanced - 16 April 2025

- Top 5 Accounting Software in Nepal (2023 & 2024/25) - 16 April 2025

- Best Accounting Software In Nepal | Oneflow Pro - 20 August 2025

- Online Accounting Software in Nepal - 12 August 2025

- How OneFlow Accounting Software Provides and Generates a General Ledger - 15 April 2025

- How OneFlow Accounting Software Generates VAT, TDS, and Custom Tax Reports - 15 April 2025

- Transforming Payroll Management in Nepal: The OneFlow Revolution - 20 August 2025

- Why You Should Choose This Business Management Software for Your Company - 11 April 2025

- The Crucial Role of Finance and Accounting in Business Success - 11 April 2025

- Why Your Business Needs Accounting Software - 11 April 2025

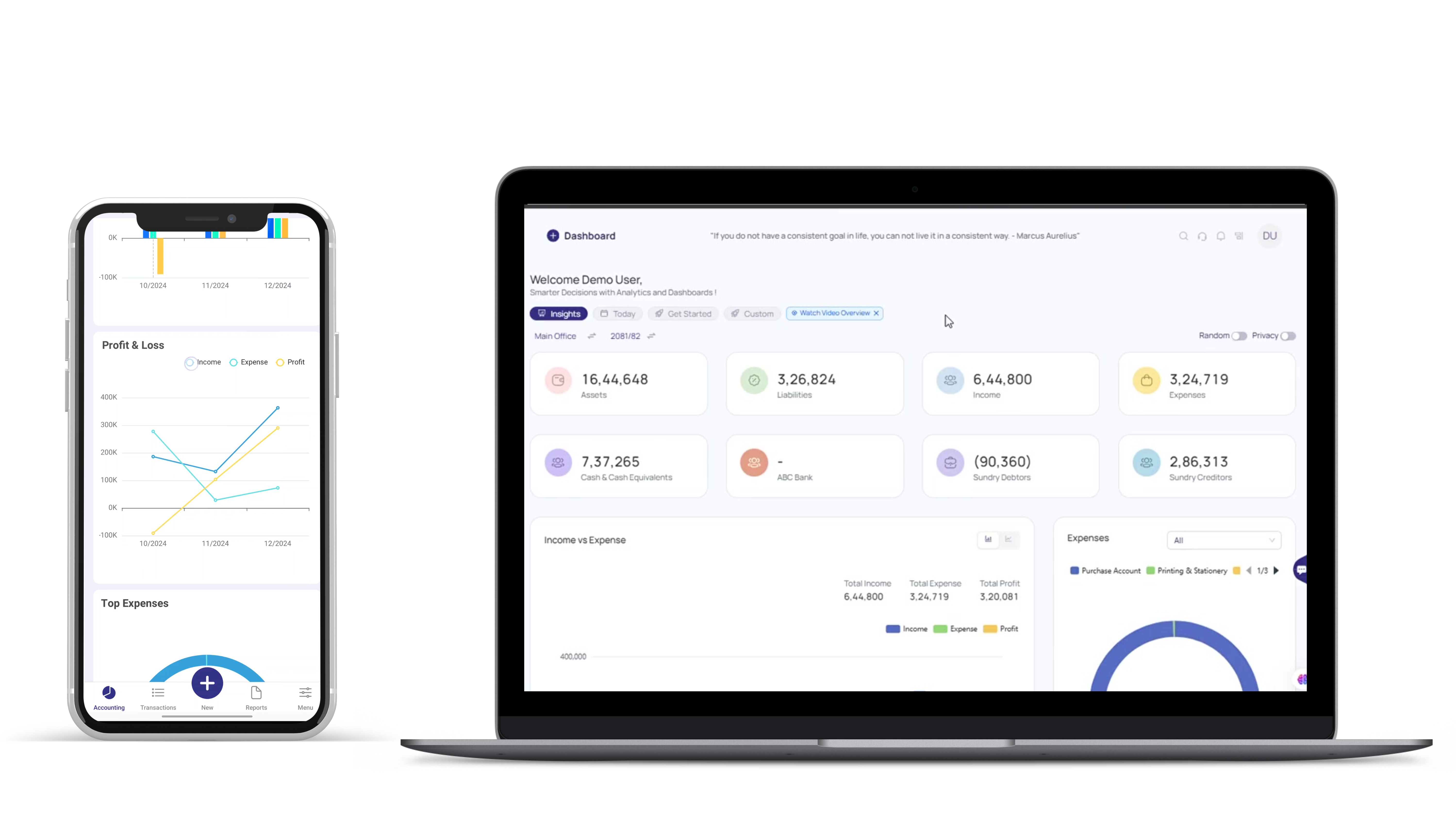

- Customizable Dashboard & Insights with OneFlow ERP - 6 April 2025

- Cloud-Based Accounting with OneFlow: Secure, Accessible, and Built for the Future - 20 August 2025

- 11 Essential Tips for Your First Year in Business: Expert Advice for Entrepreneurs - 6 April 2025

- How OneFlow Accounting Software Can Help Your Small Business Leverage AI for Efficiency - 6 April 2025

- Top 10 Essential Business Tools for Success - 6 April 2025

- Oneflow Startup Accounting Guide: Master Finances & Grow Fast - 20 August 2025